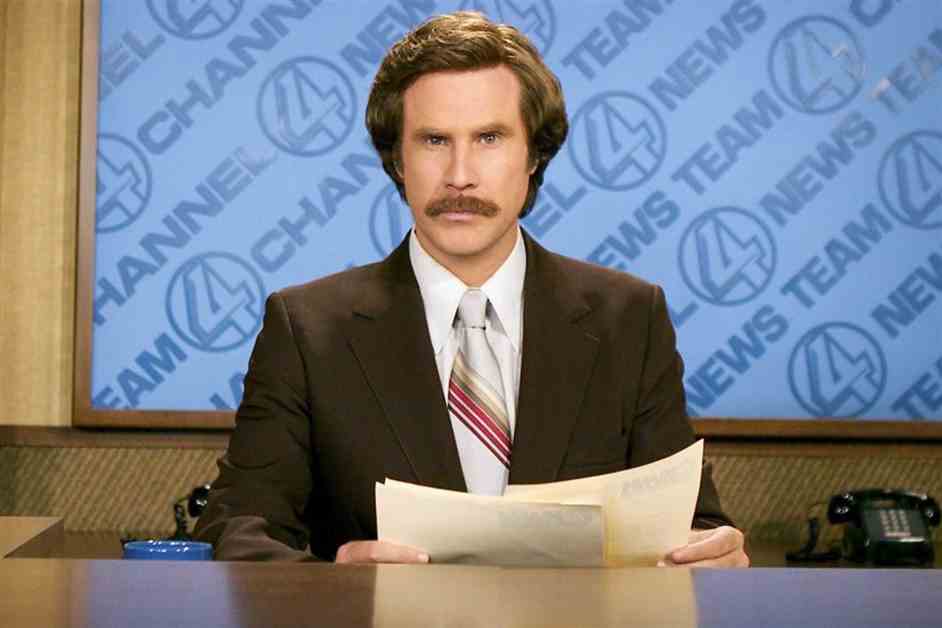

Will Ferrell Reflects on Anchorman’s 20th Anniversary

Will Ferrell, known for his role as Ron Burgundy in ‘Anchorman’, recently expressed his pride in the film’s lasting legacy as it celebrates its 20th anniversary. The movie, which also stars Steve Carell, Paul Rudd, Christina Applegate, and David Koechner, has remained a beloved classic over the years.

Despite not revisiting his character since the 2013 sequel, Ferrell shared his admiration for the film during the New York City premiere of Despicable Me 4. He mentioned how making such a unique and bizarre movie was a memorable experience and expressed joy in seeing it endure in pop culture.

Ferrell has occasionally brought Ron Burgundy back to life in various appearances, including a recent roast of Tom Brady for Netflix. During the roast, he humorously praised Brady’s looks and charisma while staying true to Burgundy’s quirky personality.

At the premiere event, Ferrell also jokingly campaigned to be named PEOPLE’s Sexiest Man Alive, showcasing his trademark humor and charm. With ‘Anchorman’ still holding a special place in his heart, Ferrell’s portrayal of Ron Burgundy continues to entertain audiences and keep the film’s legacy alive.